A Minority Owner's chronicled journey through 3 Collective Sale attempts; the last one being successful. TC was a 560 ex-HUDC estate with a thriving community spirit (up until the enblocs that is). I have moved on to a new, 37 unit Freehold estate. Life is quiet now with zero community feeling.

Tampines Court 1985-2018

Mar 29, 2012

Mar 28, 2012

The quiet time

169 units have been sold in the estate since Aug 2008 (3 of them changed hands twice); that is a 30.18% turnover.

Of these 169 units, 13 were former minority owners making up 2.32%. Since the wave of sell-offs 2008-2011 was unprecedented in the history of TC, it can be assumed that most were disillusioned ex-majority owners who couldn't wait any longer to move on with their lives. There have been fewer sales in 2012 and so, as in 2006, it seems owners are holding off any major decision making until it becomes clearer which way the en bloc wind is blowing. If an owner is thinking about selling then it is unlikely he would sign the contractually binding CSA with it's no-sale clause at this point. You also cannot price in the cost of replacement with any confidence because who knows what the market will be like in 2+ years time. Downgrading is never a problem, just don't let it become your only option..

Now there is no way of knowing how many people have changed their stance since 2008 but it can be assumed that a fair number would have crossed from the 80% to 20% and vice versa. Whether the majority in the estate are pro-en bloc or not remains to be seen. My gut feeling tells me there are far more fence sitters this time round and so the numbers signing on from month to month will be incremental at best. Low figures at the beginning could mean either a lack of interest or an excess of caution. If there is to be any real action, it will happen towards the end of the year or not at all.

Now there is no way of knowing how many people have changed their stance since 2008 but it can be assumed that a fair number would have crossed from the 80% to 20% and vice versa. Whether the majority in the estate are pro-en bloc or not remains to be seen. My gut feeling tells me there are far more fence sitters this time round and so the numbers signing on from month to month will be incremental at best. Low figures at the beginning could mean either a lack of interest or an excess of caution. If there is to be any real action, it will happen towards the end of the year or not at all.

Even the marketing agent activity is low key at the moment. Personally, I have only received a couple of calls from a rather sleepy-sounding agent just reminding me of the signing sessions. I am not complaining; owners can quietly make up their own minds this time round without any badgering or hype.

Looking at today's news:

Bartley Residences see strong demand

8 Blks: 14 -18 storeys, plot ratio 3.08, 702 units, site area 237,822 (only ONE THIRD the size of TC), 99yr LH.

By that definition, we, too, are multi-generational apartments but we cannot hope to afford a similar sized replacement home with the present reserve price. We can only look to downsize in a new estate. It is not just about the size of the new apartment, you must look at how your holding share would be diminished in these overcrowded estates. Why fork out all your 'windfall' plus $X000,000's more to swop your 1/560 share in 2,000,000sqft for 1/702 share in 733,000sqft? It just doesn't make sense to give away all your money and the equity in your home like that.

Looking at today's news:

Bartley Residences see strong demand

'We designed Bartley with the family in mind,” said Chng. “For

example, over 80 percent of the project’s 702 units comprise of

two-bedrooms and more, which are ideal for young families.”

Dual key apartments, sized at 1,603 sq ft, provide extended or

multi-generational families with the opportunity to live together in a

home within a home.'

8 Blks: 14 -18 storeys, plot ratio 3.08, 702 units, site area 237,822 (only ONE THIRD the size of TC), 99yr LH.

By that definition, we, too, are multi-generational apartments but we cannot hope to afford a similar sized replacement home with the present reserve price. We can only look to downsize in a new estate. It is not just about the size of the new apartment, you must look at how your holding share would be diminished in these overcrowded estates. Why fork out all your 'windfall' plus $X000,000's more to swop your 1/560 share in 2,000,000sqft for 1/702 share in 733,000sqft? It just doesn't make sense to give away all your money and the equity in your home like that.

The RP must keep up with rising prices of similarly sized replacement homes in new 99 yr leasehold estates.

Mar 10, 2012

Mar 1, 2012

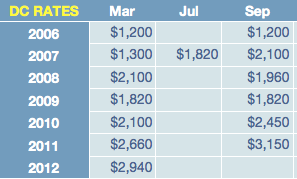

DC Rates Mar 2012

March 2012 Revision of Development Charge rates: URA Media Release

Tampines Court is Sector 98, Use Group B2: DC Rate: $2,940

The DC rate has gone down.

Tampines Court is Sector 98, Use Group B2: DC Rate: $2,940

The DC rate has gone down.

Subscribe to:

Comments (Atom)