Differential Premiums (to be paid by Buyer) :

1) for Increase in Intensity of land (from low to higher plot ratio)

2) for Lease Top-Up (LUP) - topping up to 99 years for leasehold developments

LUP: is the Lease Upgrading Premium.

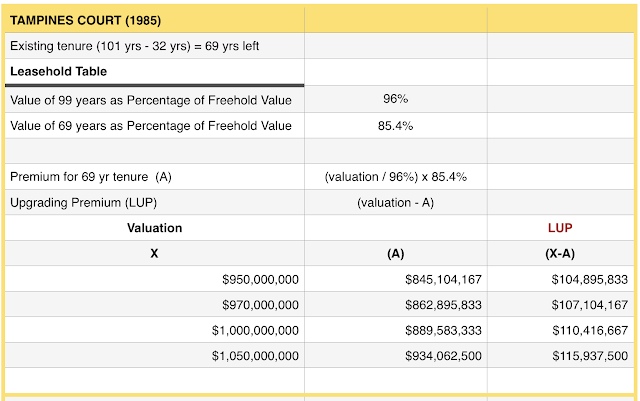

Tampines Court has a 101yr lease from 1985 of which we have about 69 years left.

The Buyer has to pay for the Differential Premium for

1) The Increase in Intensity - in other words they can squeeze more units out of the plot when the plot ratio is increased from the old 1.71 (or 1.5558 TBD) to the masterplan 2.8.

This is a relatively straightforward calculation using Government tables and I can see no mention of it in the S&P (though I will check again)

(Our MA refers to this increase in intensity as DP, others refer to it as DC)

(Our MA refers to this increase in intensity as DP, others refer to it as DC)

2) The Upgrading of Lease Tenure (the LUP)

Now this is done by the Government's Chief Valuer - so the Buyer has to wait and see what it is.

If it is anything more than $115m then the Buyer can abort the sale (Clause 3E in S&P)

Will $115m be enough? Have they underestimated the LUP?

Nobody can say for certain that all will be right on the day. No one can guarantee that the sale is a done deal until.... it's a done deal.

The Step 2 below is a worked example from the URA website

For the life of me, I cannot figure out how it is done. it seems to be a chicken and egg situation - I suppose that is why it is left for the Chief Valuer to do. Step 2 seems straightforward enough once you know the market value of the land. Now, there's the rub: to know the market value of the land, you need to know the LUP.

It's a conundrum.

If $115m is the upper limit for this Buyer, then the 'valuation' had better not exceed $1.05b if my table is correct ... and I am not sure it is. My nomenclature might be off, too.

Will $115m be enough? Have they underestimated the LUP?

Nobody can say for certain that all will be right on the day. No one can guarantee that the sale is a done deal until.... it's a done deal.

The Step 2 below is a worked example from the URA website

For the life of me, I cannot figure out how it is done. it seems to be a chicken and egg situation - I suppose that is why it is left for the Chief Valuer to do. Step 2 seems straightforward enough once you know the market value of the land. Now, there's the rub: to know the market value of the land, you need to know the LUP.

It's a conundrum.

If $115m is the upper limit for this Buyer, then the 'valuation' had better not exceed $1.05b if my table is correct ... and I am not sure it is. My nomenclature might be off, too.

The following is UNCONFIRMED. I am not a peddler of fake news - that's why I am telling you that the following information only came to be by email. If it turns out to be false, I will say so.

I heard a report today that Rio Casa and Serangoon Ville have to absorb the DP difference between the estimated DP and whatever it is now. At the time of sale, the newspapers gave $208m & $195m respectively as the estimated DP (lumping both items 1) and 2) above into one sum).

I heard a report today that Rio Casa and Serangoon Ville have to absorb the DP difference between the estimated DP and whatever it is now. At the time of sale, the newspapers gave $208m & $195m respectively as the estimated DP (lumping both items 1) and 2) above into one sum).

It goes to show that cutting corners does not pay in the long run.

This is what happened to Regent Gardens in 2008

I heard a report today that Rio Casa and Serangoon Ville have to absorb the DP difference between the estimated DP and whatever it is now. At the time of sale, the newspapers gave $208m & $195m respectively as the estimated DP (lumping both items 1) and 2) above into one sum).

I heard a report today that Rio Casa and Serangoon Ville have to absorb the DP difference between the estimated DP and whatever it is now. At the time of sale, the newspapers gave $208m & $195m respectively as the estimated DP (lumping both items 1) and 2) above into one sum).It goes to show that cutting corners does not pay in the long run.

This is what happened to Regent Gardens in 2008

Who is going to decide if we are asked to fork out the difference. CSC or SPs ?

ReplyDeleteI thought the current norm is developer should pay for differential premium. For SV and Rio Casa, wouldnt paying the DP 'eat' quite substantially into their proceeds?

ReplyDeleteIt depends on their S&P conditions, whether they are obliged to cough up the difference.

DeleteI can't see this in our S&P - only that the sale is aborted if the LUP is over $115m.

The DP+LUP are important deductions in the RLV (there's that word again). It is in the Buyer's interest that the SC/MA/Valuation OVER-estimates this cost as it means lower sales proceeds for owners because it is deducted from the GDV. If the DP-LUP turn out to be lower than estimated then the Buyer makes a huge savings and the owners still get the same proceeds.

If it is true ... and I repeat this is just a rumour.....that Rio Casa and Serangoon Ville UNDER-estimated the cost, then it all depends on their S&P what happens next.

Mark my words, TC will be sold regardless of LUP figures. If you look at the total costs of land paid by the developer in terms of psfppr, they are getting a fantastic deal. Even if the LUP crosses the red line, one must remember whatever additional costs is spread over 2000+ potential units in the new development. I believe they find it prudent to put the condition in against the backdrop of uncertain increases in land costs..but now the tiger has gotten a taste of the lamb meat, it will be hard to wrestle the lamb away from it. The developer is familiar with the folks of Tampines,...they should be aware tampines folks are not miserly and is prepared to pay for good quality housing...so far the GLS has only turned up land parcels at avenue 10..where?....wait till they launch the new development at street 11..anyone that worries about not being able to sell all the units within 5 years obviously does not know tampines well and rightly does not deserve to get TC...kudos to Sim Lian for recognizing tc's potential. I think the chap running the project is a second generation guy...too bad company has been taken private and we are unable to buy their shares....else this type of gumption will definitely take the company very far...

ReplyDeleteI also agree SL should not give up this opportunity. If we go to round 4 they may not able to get it back as more & bigger competitors will be bidding for our land. SL got more to lose than us.

DeleteGatekeeper of TC: are you not happy with the present price or source say you want to live in TC forever so is true, if the enbloc failed you are happy.

ReplyDeleteHi blogger, what is the estimated value of the LUP you think the chief valuer will come up with base on baseline etc? I dont think it will be very far from from 115 mil, give or take 5 mil more, which developer can easily top up

ReplyDeleteDid not see your 3 Qns in the FB page.

ReplyDeleteAnyway, don't see the point - you're fearful of something springing up, like all the fake news and seeds of doubt that have proliferated through this blog which has made many readers very uncomfortable.

All will be answered in a few days, so much as you say you do not intend to scuttle the enbloc, you know pretty well that that's what you want to do given your craving self serving need to remain relevant.

Reading this blog is not compulsory. We are reaching the zenith of the sale process and you should know by now I am not just going to close shop just when it is all getting oh so interesting - not just for our estate but for other exHUDCs, too.

DeleteAll will be answered in a few days... I hope so, or sooner, please.

Re your above PR 1.71

ReplyDelete.

Why JONES LANG LaSalle says in valuation report 2011 that baseline is 1.558 ,as.stated in state lease.

http://www.tampinescourt.net/2016/06/my-ballpark-residual-land-valuation.html?m=1

Missed that

DeleteThanks. Could be correct,so

If the LUP crosses 30mil or more, do you think the developer is able to absorb it?

ReplyDeleteLady please relax don't always jump into conclusions, don't give people heart attack there a lot of old people living here.

ReplyDeleteActually I don't blame the blogger to try to ascertain the missing information. The SC/MA is so in responsive & slow in updatimg the SPs.

DeleteThat's right,

DeleteJust worried someone got heart attack go hospital unnecessary because of they are concern about this enbloc.

Lady do some good and positive things please, stop doing negative and unconfirmed things making majority old people suffer here.

They can't relax after reading this blog.

Thanks lady.

Last 2 days sim lian surveyors was doing measurment of the estate

ReplyDeleteYes, give the old folks a break. Dont let them go before they see the $ in the bank account!

ReplyDeleteHi blogger...maybe u want to put your analytical skills to good work and change topic a bit; no point harping on the enbloc as it is now beyond us already. Maybe you want to share with us which properties are you considering going forward....though i know this can cut both ways, to some, it will mean the list of properties to avoid!...though i like to believe you have your own fans also...so for your loyal supporters, it would mean narrowing down for them which properties they can go look see. that said it is getting harder these days to spot the next gem...

ReplyDeleteI will take your advice, though I am not going to share locations etc... why would I invite competitors?. :)

DeleteHi blogger,

ReplyDeleteThere was a discussion on the other thread. Would like your opinion on this, actually if enbloc goes by private treaty route, would it be a better deal ( in terms of conditions, pricing etc)?

It honestly makes no difference. Tender or private is still subject to negotiations. Nothing is binding until a contract has been signed.

DeleteEarlier I mentioned why Sim Lian will buy TC regardless of LUP..they have gotten a superb deal and would be foolish to give it up..i try to put the numbers in layman’s terms so that everyone really can see what your unit in TC is worth…

ReplyDeleteTotal built up area that can be built on TC land…

2.16 million sqft (702K sqft x 2.8 x 10% bonus)

At an average size of 900 sqft per unit,, they can build about 2400 units. I may go into why its 200% possible to move all these units in 5 years in another post as I do not want to give too much info and confound the issues here. Those analysts, developers who worry sick about whether can move so many units over 5 years obviously do not know the demographics of tampines folks. SL who have done 2 developments (one ec and one DBSS I think) in tampines benefits from this ignorance.

At an average price of $1 million (some will be higher; some lower depending on size ; a reasonable 1,111 psf; any excess can be attributed to marketing cost), they can expect to net 2.4 billion dollars in gross revenue

Less DP/LUP top up of 400 million (high side liao; DP about 260mil…LUP est 120mil...although they cap at 115mil (which not only represent an exit clause for them, its also an exit clause for TC!)..

Less construction cost (30% est) = 720mil (also high side liao since they own the construction co)…any case, it is money from left pocket to right pocket…in other words, construction they also make…

Less 10% proft of 240mil (I even take care of their profit for them)…

= 1.04 billion till now

Less 970million (from kind TC folks who think their unit is worth 1.3mil nia…some who really has no idea what each unit is worth, even sell at 900k in the open market!)

= 70mil….just good for any interest incurred on loans taken (I would imagine this can be saved also as I would expect this prudent developer to amass a huge war chest over the years and don’t need too much financing) admin, sales costs etc..

….so our friend SL on paper is very in the money on this deal…so pls do not worry they will back out unless they are really daft and not sure what they are doing. I think by putting the LUP cap in, they are also risking the possibility that TC may walk ..but that possibility is low as there are still TC folks who like to bash their own estate and think “got people buy happy liao..if sell later DP/LUP very high…sounds right but mostly wrong!)…by the way rich people become rich because of the ignorance of others.

That said…I expect developer to earn about 300mil (sales and construction..depends on how they account for it in the books) …from the whole deal…and that’s conservative already…not only that, their company and groups of companies will be kept busy for the next 5 years….a very important consideration.

That’s why I concluded its hard to wrestle the lamb away from the tiger once it has sunk its teeth into it. In any case, if they really daft and back out, we will know where to begin on enbloc 4.

TC patriot

Wont' back out. Tampines is their niche.

DeleteCounting your chicken before they are hatched? Don't forget with Conditions. attached.Other places like Eunos Ville and Shunfu Est. have good MRT connectivity. TC is on vey narrow road on St.11....poor infrastructure in/out.

ReplyDeleteWhere are you from ? A jeolous SP from a failed enbloc hudc or an ex TC SP who regreted selling yr unit too early ? Dont be a sour grape. TC is a gem in the east. Can you find another land as good & big as ours at the vicinity ?

DeleteWhat gem talking you? The real gem is "GEM RESIDENCES" walking distance to MRT.

Deletehttp://www.condolaunchsg.com/properties/gem-residences/

DeleteSL will apply to ask the silver zone to be remove or have another exit at the slip road to PIE

ReplyDeleteI disagree on the above that it is down to ignorance, as there is a real potential ABSD risk to clear 2000 plus units in less than 5 years taking into account construction time etc, look at D'Leedon, not even cleared till now. But what SL could be preparing to do similar to waterfront, launch out different condo projects at different periods to help clear the units.

ReplyDeleteD'Leedon isn't mass market. They created the ugliest monstrosity of a building with units at sky high prices. NO wonder they are struggling to sell them all.

DeleteDevelopers have 2 loopholes to escape the ABSD: they can either delist or sell to a subsidiary.

There is already a hint of selling the development to a 'Nominee" (see Clause 9A).

What's that about? Splitting the land between two companies to build 2 different estates?

Yes it is not mass market, those buyers who bought in early must be raging over the premium paid. Another mass market condo Trilinq is getting affected by ABSD as well. I think you got it confused with QC. ABSD affects even developers not listed. I am not surprise that could be their intention.

DeleteActually, I think they are trying to reduce their ABSD with this 'Nominee' company.

DeleteSee how the Gov is mulling about plugging this loophole :

http://www.straitstimes.com/business/government-to-plug-loophole-in-residential-property-stamp-duty

pls see what surrounds d leedon, interlace...and then see what surrounds tc. the 2nd generation tampinites has already grown up and its very natural to want to buy something nearby...familiar surroundings and near parents...and tampinities has the wallet to back up their purchase...dont be like other analysts who just analyse with their eyes close...unless you tell me tampines not a nice place to stay, then maybe they will buy somewhere...tampines is one of the towns with a high density of hdb flats...go figure the level of latent demand.

ReplyDeleteBased on my estimate, 989M is the maximum valuation in order to not exceed lease top up of 115M. Below my working

ReplyDeleteSay chief valuer valuation is 989

Freehold value (based on SLA table) is 989 / 0.86 = 1150.

99 year LH value is 96% of FH value = 1104

Therefore, lease top to to fresh 99 years is 1104 - 989 = 115M

If my calculation is correct, the MA is not conservative enough in setting the lease top up and potentially setting up a "get out of jail" card for bidder

calculation not like that...it should be

DeleteVal99 - Val99/0.96*0.854 = 115...

Val99 = 1.04+ billion....

although primary school maths suffice, i suspect SC, MA and lawyer has no idea what is the implication of the 115 number...

tc patriot.

Beauty is in the eyes of the beholder. D'Leedon may not have been a sell out project, but taking into consideration of the psf they paid, i.e. around 762 to 783 psf, why would it matter if they can't sell out remaining 1 to 3% when their average selling price was more than double i.e. 1700-1800 psf? Think big picture TC SPs.

ReplyDeleteSecondly, D'Leedon is in D10, CCR. It's a different product category. Akin to saying why do people buy Toyota instead of Mercedes.

Thirdly, this post will probably upset some here, but why care, you guys are now newly minted millionaires.

FYI: I don't own D'Leedon and neither do I find it gorgeous. I am just simply pointing out flaws in the arguments being presented.

Welcome new readers, including jokers, busy bodies and self acclaimed experts! (seem no ex-military guys here though) This space is getting interesting....

ReplyDeleteSometimes better to go with 'self acclaimed experts' who at least have some clue on whats happening than to follow experts who may actually be totally clueless on whats happening.

DeleteThere must be a basis to any number that is put forth...else is nothing more than pluck from air and practically useless to any decent conversation. My guesstimate is based on 2 recent land sales in tampines ave 10...and i would like to believe chief valuer will also look at that...the first is acquired in 2015 at 482.60 psfppr(CDL)..while the latest one was sold for 565.42 psfppr.

ReplyDelete(MCL). Valuation usually runs behind the market so they will not take the latest one. They probably will take the middle...which is about 524...we also have to account for the fact bigger land size has a lower psf..so it could actually be lower than that but this is moderated by the fact st 11 is in some ways better than ave 10 (i dont think tc folks will quibble with me on that point)...so it is fair to use the 524 figure...and base on this number...we get 1.03 billion or a est LUP of 114..below the cap. Even if they take the latest at 565.42 it will mean a land value of about 1.11 bil.translating to a LUP of around 122mil...that was the basis for my est 120mil...beyond the cap..but which i have argued in my earlier post developer will just go ahead with the deal.

tc patriot.

Wat u quote are fresh 99 years land with full PR.BUT market.sentiment hv chz a lot.

DeleteLand value.is very senstive to condo price. Eg if condo price increase 10%.land.value increasr more than such 10%.

Fresh 99 years of TC is price offered by bidder,plus DP ,plus LUP.the full sum is around 1.5 billion.

Why? Becos all bidder work back the offer price in this way.

They deduct DP n LUP fr the value of fresh 99 years lease of TC,based on PR 2.80.

Amber Park sold 1515 psfppr....holy mama

ReplyDeleteThis few days I have been seeing surveyors doing survey at TC. Should be from SL ?

ReplyDeleteinspecting the goods if you will..making sure everything conforms to stated specs..i think it has been a while since the surveyors surveyed such a big piece of lamb...i mean land.

DeleteAll hudc going enbloc :

ReplyDeletehttp://www.channelnewsasia.com/news/business/all-remaining-7-ex-hudcs-have-started-en-bloc-process-9275154

Given what has happened to FR enbloc exercise. Does this mean that TC now has to worry both about the LUP and the independent valuation?

ReplyDeleteCV valuation is the market price of a fresh 99 years on PR 2.80.

ReplyDeleteOr equal to developer willing to pay for it.

This include tender price to TC owners ,DP and LUP.

HI blogger,how do u get 1.11b?

Appreciate for the LUP figure, rather then don't know the answer to the LUP. Thank you!

ReplyDeleteI don't know the answer :(

Deletere blogger says,

ReplyDelete【A. To determine the valuation of the land, the valuer must know the DPs

B.To determine the valuation of the land, an estimated (best educated guess) LUP & DP is used in the RLV 】

A.CV get open market of TC on basic of 99

years and PR 2.80,by referring to land sales across singapore n do a residual valuation. Cb dunt need refer to DC table nor DP.

B. If u refer land valuation which is paid by bidder to TC owners,answer is yes.

If u refer to open market valuation,

Answer is no.

Have a question. So the valuation at the close of tender is just 'opinion', only the chief valuer one is the truly accurate one. Like that the independent valuation is like a repeat job, must as well go to URA to get the most accurate valuation from the start?

ReplyDeleteTry getting the Ministry of Law to agree to those sweeping amendments to the LTSA.

DeleteWhat? Put the power in land owners hands instead of marketing agents and developers? Give clear and correct information at the start instead of the end? Provide a one-stop 'Collective Sale Government Department' to handle all requests from collective sale committees for Development Baselines, DPs etc?

In your dreams.

The Vultures rule the enbloc sky.

If CV help TC owners to value,it may be politically incorrect.

DeleteMA,CSC ,Valuer should be servants of TC owners,not master.

Eg. CSC can look for valuer who will explain to their figures,.

How much is TC valuation reporti think 100k.

I think backwards. Anyone knows that SL bid any other land? Not as I know. At least they never win other bids except TC, which means they are committed to focusing on TC. Agree or not?

ReplyDeleteThey are a major player in construction: I count 5 residential projects selling presently and 15 residential sold historically.

Deletehttp://www.simlian.com.sg/

Recently SL is very quiet after bagging TC. They don't bid other projects. I don't think SL will withdraw even LUP is higher.

DeleteWondering any objection at STB ? What taking so long for the LUP.

ReplyDeleteWhile one can talk about the worry of the LUP condition being busted and the contract rescinded,...one can also present the same argument that it may actually be a good thing for TC. Looking at the table in the sunday times today, Sim Lian looked the smartest among all the developers with the best deal - biggest land so far at the lowest psfppr...and in a regional centre which has one of the highest concentration of HDB flats...all potential upgraders. In the event the contract is rescinded due to LUP, i think the sales com will be able to open shop again and enter into a private treaty with another interested party. I believe if we have another roll of the dice, we can do better than 970m,..of course the desperados in the estate will scream otherwise.."got people buy..take money and run!" My point is this - end of the day, if the contract is rescinded, it may not be a bad thing..and i suspect on hindsight the boys in SL may be regretting putting the LUP clause in the S&P..as now it gives a chance for TC to walk.

ReplyDeleteLup clause may b one way contract.SL may choose to cancel,but SC cannot.

ReplyDeleteRead the fine print.