A Minority Owner's chronicled journey through 3 Collective Sale attempts; the last one being successful. TC was a 560 ex-HUDC estate with a thriving community spirit (up until the enblocs that is). I have moved on to a new, 37 unit Freehold estate. Life is quiet now with zero community feeling.

Tampines Court 1985-2018

Dec 26, 2012

Dec 15, 2012

Nov 30, 2012

Nov 20, 2012

Nov 9, 2012

The Final Push

Two more signing sessions are penciled in for Nov, and a letter from the SC Chairman on the Notice Board (The letter has since been removed).

Nov 3, 2012

Oct 21, 2012

Oct 1, 2012

Sep 26, 2012

CPF changes

Changes in how CPF is refunded into your account when you sell your property:-

The CPF (Amendment) Bill 2012 Second Reading Speech by Acting Minister for Manpower Tan Chuan-Jin

CPF News-Release 10 Sept 2012

| REFINEMENTS TO THE CPF HOUSING REFUND POLICY |

| Sir, I will now move on to the next amendment that will give effect to refinements that we are making to the CPF housing refund policy. CPF members may use savings in their CPF Ordinary Account (OA) to purchase a property. When members sell off their property, we require them to refund the CPF savings that they have used for their property. |

| Current housing refund policy |

| Members who sell their property before age 55 are required to refund into their CPF account the principal amount that they had withdrawn for the property, including the prevailing OA interest that would have accrued on this amount, or P+I in short. This refund aims to restore the member to the position as if he had not withdrawn his CPF savings for the property. Members may still use the refunded amounts towards the purchase of their next property. |

| The current housing refund requirements change when a member is past

age 55. At age 55, a member is required to set aside the Minimum Sum

(MS) from his existing CPF balances, and he may withdraw his CPF savings

in excess of the MS after having also set aside the required amount in

his Medisave Account for his healthcare needs. So when a member sells

his property after age 55, only the amount needed to bring the member up

to his MS must be refunded, since amounts above the MS can be withdrawn

anyway. In other words, for a member who sells his property after age

55, he will refund his MS shortfall or his P+I, whichever is lower.

Remaining proceeds from the sale of his property is received in cash. While the current refund rules for members over 55 avoid collection of housing refunds in excess of MS, there may be certain scenarios involving more than one co-owner, where the refunds required of the co-owners may not match the amount of CPF each co-owner used to pay for that property. When this arises, co-owners can decide to distribute the cash proceeds among themselves such that the total of the cash proceeds and CPF refunds for each co-owner matches the amount that each co-owner had contributed towards payment of the property. However, where the co-owners are no longer on good terms, the distribution of cash proceeds becomes more contentious and the co-owners may not always be willing to consider the amount that the other party has contributed towards the property. In cases where the property is sold at a loss, there may not be any cash proceeds for distribution. This is when the current housing refund requirements may create some unhappiness among members. Some of the Members of this House would have received appeals of such nature. |

| New housing refund policy |

| We are therefore refining the housing refund policy to address this issue. We will now require members aged 55 and above to refund their P+I. This means the same refund rule will apply to all members regardless of their age. This refinement will ensure co-owners receive CPF refunds that are commensurate with their usage of CPF savings for the property. Sections 21, 21A and 21B of the Act will be amended to give effect to the new housing refund policy. |

| Where the P+I refund exceeds the MS shortfall for members aged 55 and above, they need not worry that the new refund rule makes them retain in their CPF a higher amount than what is necessary. The refunded amount will first be used to set aside their cohort Minimum Sum in their RA and the required Medisave amount in their MA, and the excess can be withdrawn. This is no different from the existing requirement that applies to all members past age 55 who wish to withdraw their OA and SA savings in excess of the MS. |

| Under the new housing refund rule, for members aged 55 and above, any remaining housing refunds after setting aside the required amounts (in the RA and MA) will be automatically disbursed to the member in cash, unless he chooses to retain it in his CPF accounts. Changes will be made to section 15 of the Act to give effect to this policy. The majority of members can expect to receive the disbursed funds within one to two weeks of the crediting of the housing refunds into their CPF accounts. |

| Sir, the new housing refund policy will ensure that the distribution

of proceeds from the sale of property reflects the CPF usage among the

co-owners, while at the same time not require older members to retain in

their CPF more refunds than are necessary. The new housing refund

policy will take effect on 1 January 2013.

My Question:

Just asking |

Sep 17, 2012

We are no 1 when it comes to SPACE

SPACE is the new luxury... not lap pools and skyparks.

It's good that the media has shone a torch in our direction because not everyone knows about HUDCs and their value-for-money size.

Sep 8, 2012

AGM 2012

Attendance: 49 units (out of 560) at 2.30pm, which is 19 more than last year. Quite a crowd, really :)

A very civilized meeting and well chaired by the MC Chairman. Everyone seemed to be in the same boat and rowing in the same direction. Sensible questions were asked, reasonable objections were offered and even though it dragged on a bit, all matters were discussed fully and either passed or failed without any aggravation whatsoever. The SPs present, both for and against enbloc, put the estate first and a number of changes are now going to be implemented.

- The monthly maintenance fee was increased by $20. So owners will now pay $168 (excl GST) instead of the present $148. This change passed unanimously, though a couple of SPs grumbled that it should not have been left to last, as a few SPs had left early.

- Interest on arrears increased to 15%

- All the present committee members (7) will continue on the MC with the addition of 3 more SPs.

- The roof waterproofing works will proceed.

- The special resolution to install ERP and charge for visitor parking was put to the vote. 65% voted for the proposal, 35% were against. It was therefore NOT passed.

- The special resolution to install gates at the entrances and turnstiles at the side gates was passed unanimously.

- The special resolution to build BBQ pits was rejected unanimously.

- The special resolution to charge $100 monthly parking fee for second car, $150 for 3rd car and $200 for 4th car was passed unanimously.

- Special resolution to force a sale of a unit in arrears was passed unanimously.

En bloc or no En bloc, the estate is doing fine.

Sep 7, 2012

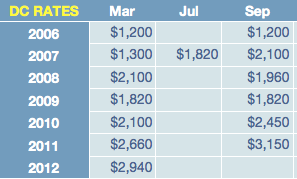

DC Rates Sept 2012

March 2012 Revision of Development Charge rates: URA Media Release

Tampines Court is Sector 98, Use Group B2: DC Rate: $3,290

DC Rates for Sept 2012

'The largest increase in Group B2 rate is in Sector 98 (Bedok North / Simei / Tampines New Town) at 12%. '

Tampines Court is Sector 98, Use Group B2: DC Rate: $3,290

DC Rates for Sept 2012

'The largest increase in Group B2 rate is in Sector 98 (Bedok North / Simei / Tampines New Town) at 12%. '

Sep 6, 2012

We are not alone

You know it's a slow news day when the cleaning woes of a housing estate (HUDC Braddel View*) makes it to the front page. But even still, there is something here that we should all be reminded of; that every estate has it's fair share of problems and there is no such thing as a problem-free environment.

The AGM for Tampines Court is this Saturday. There may be owners who will raise issues and try to frame them either as shortcomings of the management committee or evidence that the estate is falling apart.

A level headed person can tell the difference between hyperbole and wear & tear. Paint peels, pipes rust, corridors need to be swept etc. These are common occurrences and are dealt with in the normal course of managing an estate. There's no need to panic.

Let us remember that the estate has been well managed over the past year, the accounts are in the black and there has been no disaster. The neutral MC are proposing only modest and sensible resolutions. Only small matters can be dealt with when the threat of a collective sale hangs over our heads. The larger issues can be tackled after the attempt has failed.

* Braddell View is the only HUDC estate that has not been offered privatisation under existing law. The estate was built in two phases, in two land parcels and has two land expiration dates. Residents will need to top up the lease tenure of the land parcel with the shorter lease to align it with the longer one.

* Braddell View is the only HUDC estate that has not been offered privatisation under existing law. The estate was built in two phases, in two land parcels and has two land expiration dates. Residents will need to top up the lease tenure of the land parcel with the shorter lease to align it with the longer one.

Aug 14, 2012

$1.2 million here we come

Recent caveat lodged: $ 1.16 million. (And the lucky seller is none other than an ex-SC member who made a cool 100% profit :)

I recently had a conversation with someone who was contemplating buying a unit in Loyang Valley - an estate older than ours (we have 101yr lease) and about 27yrs into their 99yr lease. There is a common misconception about the 30yr mark and how the banks 'won't lend to potential buyers after the 30 yr mark, so you had better go en bloc'.

Many people believe this 30yrs refers to when the estate is 30 yrs old. This is incorrect. The difficulty arises only when the estate has only 35yrs remaining on the lease (ie, the estate is 65yrs old).

So the aging estate/bank difficulty scare tactic is bogus. We have many happy years of reselling ahead of us. The upward trajectory in resale prices in the present bullish market has therefore every prospect of continuing.

Aug 12, 2012

Tilting at Windmills

There was a dialogue session with owners on July 28 and to date we have not seen any minutes of this meeting on the notice board. I am only now getting a little feedback on what transpired.

I believe one issue raised by a SP in the estate was that the end staircase of block 123 was tilting.

Fiddlesticks. As an owner who uses that particular staircase every day of my life I can say that I have never noticed such a tilt - if it indeed exists. And what was this SP implying anyhow? That our HDB-built estate is structurally unsound?

I hope the managing agent might come out and assure all SPs that Tampines Court is as solidly built as all the other HDBs that surround us; that minor imperfections, if they are found to exist, are nothing to worry about.

What other points were aired at that meeting? We are well used to scare tactics, but really this one sounds like desperation to me. Tilting staircases? More like tilting at windmills.

Fiddlesticks. As an owner who uses that particular staircase every day of my life I can say that I have never noticed such a tilt - if it indeed exists. And what was this SP implying anyhow? That our HDB-built estate is structurally unsound?

I hope the managing agent might come out and assure all SPs that Tampines Court is as solidly built as all the other HDBs that surround us; that minor imperfections, if they are found to exist, are nothing to worry about.

What other points were aired at that meeting? We are well used to scare tactics, but really this one sounds like desperation to me. Tilting staircases? More like tilting at windmills.

Jul 28, 2012

Jul 9, 2012

Outdated RP

If owners were to receive the RP in their accounts tomorrow, they would not be able to buy a similar sized replacement unit in the near vicinity. There's the hassle of moving, the legal fees, the stamp duty, the renovation cost, the spectre of 560 potential owners entering the market at the same time driving up resale values and COVs in the area,... even if you sign today; you won't see a penny until 2013 at the earliest. Mass market properties in Tampines are being snapped up like there's no tomorrow. Waterfront Waves subsales have breached the $1000psf mark.

TC Round 1: RP mooted in Dec 2005 - sold Mar 2007 : 15 months unchanged in a rising market.

TC Round 2: RP mooted in Jul 2011 - now Jul 2012 : 12 months unchanged in a rising market.

At this rate the RP will be 18 months old without a revisit by the end of the year.

Any Expression of Interest now will only serve to justify keeping the RP as it is.

Any EOI now will cut the legs off any legitimate tender exercise 9 months down the road.

Any EOI now could produce our ballpark RP less 20% - prompting a likely convening of an EGM to lower the RP; or set the murky mechanism for lowering the RP in the CSA into action.

An EOI exercise should never be done simply to 'persuade' reluctant owners to sign.

.

Any EOI now could produce our ballpark RP less 20% - prompting a likely convening of an EGM to lower the RP; or set the murky mechanism for lowering the RP in the CSA into action.

An EOI exercise should never be done simply to 'persuade' reluctant owners to sign.

.

Would the name of the interested party(s) (should there be any) be disclosed to the owners? Probably not since the developer-buyer would be a public-listed company and SGX rules prohibit any such disclosure. So it might all be as transparent as a cardboard box.

Any way you look at it, going for EOI now is not a wise move.

Any way you look at it, going for EOI now is not a wise move.

Jul 6, 2012

Jun 30, 2012

No Underselling, please

* This post has not been updated in a long while. Will get around to it sooner or later.

- ITSHOMETOME'S attempt at a RESIDUAL LAND VALUATION HERE adopting the methodology used in the 2 formal RLVs handed in at the STB in round 1 and an informal RLV.

- A comparative analysis on Ex-HUDC collective sales / New Developements vis a vis GLS / New Developments.

Jun 13, 2012

GLS 2H2012

GOVERNMENT LAND SALES FOR SECOND HALF OF 2012

| Reserve list | ||||||||

| Residential Sites | ||||||||

| 1 | Jalan Jurong Kechil | Already Available | URA | |||||

| 2 | Stirling Road | URA | ||||||

| 3 | Alexandra View (Parcel A) | URA | ||||||

| 4 | Farrer Road / Lutheran Road | URA | ||||||

| 5 | Kim Tian Road | URA | ||||||

| 6 | Tai Thong Crescent (Parcel C) | URA | ||||||

| 7 | Prince Charles Crescent | URA | ||||||

| 8 | Tampines Avenue 10 (Parcel B) | URA | ||||||

| 9 | Sengkang West Way (Parcel A) | HDB | ||||||

| 10 | Alexandra Road / Alexandra View (Parcel B) (3) | Sep-12 | URA | |||||

| 11 | Tampines Avenue 10 (Parcel C) (3) | Oct-12 | URA | |||||

| 12 | Tampines Avenue 10 (Parcel D) (3) | URA | ||||||

| 13 | Jurong West Street 41 / Boon Lay Way (Parcel B) (3) | Nov-12 | URA | |||||

| 14 | New Upper Changi Road / Bedok South Avenue 3 (Parcel B) (3) | Dec-12 | URA | |||||

| Confirmed List | ||||||||

| Residential Sites |

||||||||

| 1 | Punggol Way/Punggol Walk (EC) | Jul-12 | HDB | |||||

| 2 | Dairy Farm Road | URA | ||||||

| 3 | Woodlands Avenue 6 / Woodlands Drive 16 (EC) (3) | Aug-12 | HDB | |||||

| 4 | New Upper Changi Road / Bedok Road (Parcel A) | URA | ||||||

| 5 | Sengkang West Way / Fernvale Link (Parcel B) (EC) (3) | Sep-12 | HDB | |||||

| 6 | Pasir Ris Drive 3 / Pasir Ris Rise (EC) (3) | HDB | ||||||

| 7 | Bishan Street 14 | Oct-12 | HDB | |||||

| 8 | Sembawang Crescent / Sembawang Drive (EC) (3) | HDB | ||||||

| 9 | Punggol Field Walk / Punggol East (EC) (3) | HDB | ||||||

| 10 | Ang Mo Kio Avenue 2 / Ang Mo Kio Street 13 (3) | Nov-12 | URA | |||||

| 11 | Jurong West Street 41 / Boon Lay Way (Parcel A) (3) | URA | ||||||

| 12 | Commonwealth Avenue (3) | Dec-12 | HDB | |||||

Fantastic

This is great... an Anonymous poster found a new website that takes care of all that tedious data collection and presents it in a clear and easy to read way.

Anonymous said...

Useful Website for Property!

Hi,

Sharing this property research website with everyone

http://www.squarefoot.com.sg

It publishes all the caveats, rental data, and makes price comparisons. For example, take a look at The Sail: http://www.squarefoot.com.sg/

If you are looking at a specific unit, you can enter the unit number at the top and it will pull out the data for that unit

It also has caveats for non-residential properties, for example Suntec City: http://www.squarefoot.com.sg/

Just thought you guys might find it useful

The site also has good research articles and reports

Enjoy!

Hi,

Sharing this property research website with everyone

http://www.squarefoot.com.sg

It publishes all the caveats, rental data, and makes price comparisons. For example, take a look at The Sail: http://www.squarefoot.com.sg/

If you are looking at a specific unit, you can enter the unit number at the top and it will pull out the data for that unit

It also has caveats for non-residential properties, for example Suntec City: http://www.squarefoot.com.sg/

Just thought you guys might find it useful

The site also has good research articles and reports

Enjoy!

Thank you Anonymous!

As pointed out by another Anonymous comment: the data for TC seems a bit off

There is no way that 70% of units are owned by Companies in TC.

The last time I downloaded such data was last year and here it is:

Because TC was privatised in 2002, there is no data on ownership prior to that date. So I am assuming that because there is missing data on the Realis books- they label them company? The data is only for those units that changed hands since 2002. And since 2002, NO COMPANY has bought a unit.

Hi!

I am from square foot. Thanks for highlighting the unusually large percentage of company purchases for Tampines Court. I just checked. The caveat for Far East / Frasers 07's en bloc purchase remains in Realis although it didn't succeed, hence the error in breakdown. The breakdown is based on number of units so you can imagine the weight that the failed en bloc transaction carries. I've amended our data. See http://www.squarefoot.com.sg/

The updated breakdown is Singaporean 207, PR 19, Foreigner 6

Hope you find the website useful!

Thank you, Sir. Your website is excellent.

As pointed out by another Anonymous comment: the data for TC seems a bit off

There is no way that 70% of units are owned by Companies in TC.

The last time I downloaded such data was last year and here it is:

REPLY FROM SQUAREFOOT ( and I didn't even email them)

Hi!

I am from square foot. Thanks for highlighting the unusually large percentage of company purchases for Tampines Court. I just checked. The caveat for Far East / Frasers 07's en bloc purchase remains in Realis although it didn't succeed, hence the error in breakdown. The breakdown is based on number of units so you can imagine the weight that the failed en bloc transaction carries. I've amended our data. See http://www.squarefoot.com.sg/

The updated breakdown is Singaporean 207, PR 19, Foreigner 6

Hope you find the website useful!

Thank you, Sir. Your website is excellent.

However, your updated TC data is still not quite there...

As I said before, the data only goes as far back as 2002 and only 41% of units are reported in Realis. 207 Singaporean buyers may represent 89.2% out of the 232 in the data.... but there are 560 units in total in TC.

The correct percentages should therefore be:

Singaporean: 36.96%

PR: 3.39%

Foreigner: 1.07%

Unknown: 58.57%

There is not much you can do about that, we are a hybrid HDB/PRIVATE creation, there are only a handful of us ex-HUDC's out there..

The correct percentages should therefore be:

Singaporean: 36.96%

PR: 3.39%

Foreigner: 1.07%

Unknown: 58.57%

There is not much you can do about that, we are a hybrid HDB/PRIVATE creation, there are only a handful of us ex-HUDC's out there..

Jun 11, 2012

May 16, 2012

Apr 29, 2012

Apr 12, 2012

The 'en bloc' factor

Most recent update: 11 Nov 2012

# This post has nothing to do with setting the RP or justifying the RP - it is simply about shedding some light on one of the oft made comments people generally make about TC resale prices - that 'they have risen primarily because of the on going en bloc attempt '

Is it true that the rise in resale prices at Tampines Court is primarily due to the current collective sale attempt? It is hard to quantify what effect an en bloc attempt might have, but at least we can start by doing a comparative analysis with other established 99yr leasehold estates in Simei, Tampines and Pasir Ris and see how TC might differ from the general trend.

So here it is:-

I have used average monthly resale $psf between Jan 2008 and Oct 2012 . Where no data was available (no sales) I have used averages (to avoid gaps in the graph).

There is an obvious pattern here; all estates have experienced a steady rise in price psf and you cannot tell by simply looking at the chart which estate is going through an en bloc. No estate deviates from the norm to such an extent as to warrant a question mark. As they say, a rising tide lifts all boats.

There is an obvious pattern here; all estates have experienced a steady rise in price psf and you cannot tell by simply looking at the chart which estate is going through an en bloc. No estate deviates from the norm to such an extent as to warrant a question mark. As they say, a rising tide lifts all boats.

TC does not seem to be advantaged nor disadvantaged by the ongoing collective sales attempt.

It is no surprise that the 3 oldest estates (TC, Loyang Valley and Elias Green) have the lowest psf, not forgetting of course TC is the only estate without any of the usual condo facilities. Our draw is location, unit size, low maintenance fee and space. Even still, we are closing the gap -which may or maybe not be due to the mysterious 'EP'.

The 'en bloc potential' cannot be discounted as a contributing factor but then again, it may be a contributing factor to some degree in the other estates, too, for all we know.

There have been 12 unit sales so far this year.

In round 1- there were no unit sales between Oct 2006 and Aug 2008 and so as the market rose, TC was left behind.

Mar 29, 2012

Mar 28, 2012

The quiet time

169 units have been sold in the estate since Aug 2008 (3 of them changed hands twice); that is a 30.18% turnover.

Of these 169 units, 13 were former minority owners making up 2.32%. Since the wave of sell-offs 2008-2011 was unprecedented in the history of TC, it can be assumed that most were disillusioned ex-majority owners who couldn't wait any longer to move on with their lives. There have been fewer sales in 2012 and so, as in 2006, it seems owners are holding off any major decision making until it becomes clearer which way the en bloc wind is blowing. If an owner is thinking about selling then it is unlikely he would sign the contractually binding CSA with it's no-sale clause at this point. You also cannot price in the cost of replacement with any confidence because who knows what the market will be like in 2+ years time. Downgrading is never a problem, just don't let it become your only option..

Now there is no way of knowing how many people have changed their stance since 2008 but it can be assumed that a fair number would have crossed from the 80% to 20% and vice versa. Whether the majority in the estate are pro-en bloc or not remains to be seen. My gut feeling tells me there are far more fence sitters this time round and so the numbers signing on from month to month will be incremental at best. Low figures at the beginning could mean either a lack of interest or an excess of caution. If there is to be any real action, it will happen towards the end of the year or not at all.

Now there is no way of knowing how many people have changed their stance since 2008 but it can be assumed that a fair number would have crossed from the 80% to 20% and vice versa. Whether the majority in the estate are pro-en bloc or not remains to be seen. My gut feeling tells me there are far more fence sitters this time round and so the numbers signing on from month to month will be incremental at best. Low figures at the beginning could mean either a lack of interest or an excess of caution. If there is to be any real action, it will happen towards the end of the year or not at all.

Even the marketing agent activity is low key at the moment. Personally, I have only received a couple of calls from a rather sleepy-sounding agent just reminding me of the signing sessions. I am not complaining; owners can quietly make up their own minds this time round without any badgering or hype.

Looking at today's news:

Bartley Residences see strong demand

8 Blks: 14 -18 storeys, plot ratio 3.08, 702 units, site area 237,822 (only ONE THIRD the size of TC), 99yr LH.

By that definition, we, too, are multi-generational apartments but we cannot hope to afford a similar sized replacement home with the present reserve price. We can only look to downsize in a new estate. It is not just about the size of the new apartment, you must look at how your holding share would be diminished in these overcrowded estates. Why fork out all your 'windfall' plus $X000,000's more to swop your 1/560 share in 2,000,000sqft for 1/702 share in 733,000sqft? It just doesn't make sense to give away all your money and the equity in your home like that.

Looking at today's news:

Bartley Residences see strong demand

'We designed Bartley with the family in mind,” said Chng. “For

example, over 80 percent of the project’s 702 units comprise of

two-bedrooms and more, which are ideal for young families.”

Dual key apartments, sized at 1,603 sq ft, provide extended or

multi-generational families with the opportunity to live together in a

home within a home.'

8 Blks: 14 -18 storeys, plot ratio 3.08, 702 units, site area 237,822 (only ONE THIRD the size of TC), 99yr LH.

By that definition, we, too, are multi-generational apartments but we cannot hope to afford a similar sized replacement home with the present reserve price. We can only look to downsize in a new estate. It is not just about the size of the new apartment, you must look at how your holding share would be diminished in these overcrowded estates. Why fork out all your 'windfall' plus $X000,000's more to swop your 1/560 share in 2,000,000sqft for 1/702 share in 733,000sqft? It just doesn't make sense to give away all your money and the equity in your home like that.

The RP must keep up with rising prices of similarly sized replacement homes in new 99 yr leasehold estates.

Mar 10, 2012

Mar 1, 2012

DC Rates Mar 2012

March 2012 Revision of Development Charge rates: URA Media Release

Tampines Court is Sector 98, Use Group B2: DC Rate: $2,940

The DC rate has gone down.

Tampines Court is Sector 98, Use Group B2: DC Rate: $2,940

The DC rate has gone down.

Feb 18, 2012

R: Meeting Minutes 11/2/2012

Further to my post Fishing for contact details about the SC trying to obtain owners contact details from the management office: they wrote in their recent minutes:

"The Management Council (MC) does not want to provide their contact particulars to SC . Many such residents are complaining to SC that they are not receiving updated notices on enbloc process. SC is trying to reach out to as many SPs as possible. However, the MC office has informed to SC member, Mr Srinivasan that there is no bar for SC to go door to door to find out details of tenanted units.

The SC also discussed on the issue of putting up notices and as per SC understanding the notices are required to be put up in the notice boards available in the Building as per the strata act. The SC decided to seek clarification from MC on this issue."

Perhaps the residents who complain to the SC about not receiving updated notices could, at the time they are complaining, offer the SC their emails/handphone numbers; that would solve the problem!

The default position is NOT that everyone in the estate would be happy for the management office to hand over their contact details to the SC and by necessity, the marketing agent! Some of us actually protect our emails addresses and number from those who would send us spam.....

Feb 16, 2012

R: Another Blog reprimanded over a comment

I came across the Blog 'Yawning Bread' which had a legal letter requesting that a comment be removed and their letter posted.

3. The allegations against our client that you have referred to in the Blog Comments have been put up primarily by a person who calls himself “scroobal’ on the internet. The allegations are false and scurrilous.

4. Our client has instructed us to try and trace “scroobal’ in order to sue him. But the internet being what it is. “scroobal’ has been untraceable so far.

5. Likewise, others who have repeated the allegations made by “scroobal’ have so far been untraceable.

6. Our client’s instructions are to commence proceedings against anyone who makes such allegations against our client.

7. We request that you take down the Blog Comments, and publish this letter in full on your website.

Ditto for my blog

Feb 13, 2012

The wicked witch is dead

Need a break from all this

en bloc brouhaha

en bloc brouhaha

Enough is enough. My blog has been compromised and as such I feel it cannot continue at this time. The CSA is out there and people will sign or not as they see fit, and we shall have to wait out the year for the outcome.

Slan agus beannacht

Oops, back from the dead to reply as it concerns me directly:...

RE: "WITHDRAWAL OF OFFENSIVE POSTINGS IN THE BLOG OF “TAMPINES COURT ENBLOC/ANTI-ENBLOC & BEYOND” on the SC Blog:-

There are a few more emails missing from the correspondence between the SC Chairman and myself with regard the Anonymous comment deletion. Thought I might as well add them for completion.

RE: "WITHDRAWAL OF OFFENSIVE POSTINGS IN THE BLOG OF “TAMPINES COURT ENBLOC/ANTI-ENBLOC & BEYOND” on the SC Blog:-

There are a few more emails missing from the correspondence between the SC Chairman and myself with regard the Anonymous comment deletion. Thought I might as well add them for completion.

Feb 2 (12 days ago)

| ||||

| ||||

Mr. (Chairman),

By the way, would you like to have your letter above posted in full on the blog? I will oblige, if so.

Regards

(itshometome)

Feb 2

|   | |||

| ||||

Dear (itshometome)

Yes the SC would like you to post the letter in full. Thank you.

Regards

(Chairman)

Regards

(Chairman)

Feb 5

|   | |||

| ||||

Dear (itshometome)

I have requested the letter to be posted in full but as of now I have not seen it. Could you please do so as you have said. Thank you.

Regards

(Chairman)

(Chairman)

| ||||

Mr. (Chairman)

I posted it immediately after the last email (Feb 2nd) . I always do what I say.

I have changed the heading to make it clearer for you to spot.

(Itshometome)

Feb 6

|   | |||

| ||||

Ms (itshometome)

Thank you.

(Chairman)

(Chairman)

Subscribe to:

Comments (Atom)